Account Based Pension Certificate

Manage your fund’s actuarial certificate requirements efficiently

If you require an Account Based Pension certificate, you can choose to request either:

- *Online Certificates for $110 (inc GST)

- *Manual Certificates for $140 (inc GST)

If you choose to have the certificate prepared manually, HA provides a same day turnaround service.

For certificate purposes, account based pensions include term allocated pensions, market linked pensions and post-retirement transition to retirement pensions.

Account based pension certificate requirements

For the purposes of Income Tax Assessment Act 1977 Sections 295-385 and 295-390 (which deals with the proportion of the fund’s income that qualifies for exemption from tax), account based pension certificates are required if the fund’s assets are not fully segregated to individual member accounts and if there were at least one accumulation balance and at least one pension balance throughout the financial year.

Click here to view the ITAA Extract

Note that an actuarial certificate is not required if the Fund has incurred a tax loss.

With effect from 1 July 2017 the method by which exempt current pension income (ECPI) is calculated was changed.

Up until 1 July 2017, if the assets of the fund were a mixture of accumulation and pension assets, only a proportion of the investment income (including realised capital gains) generated in the year was exempt from tax (pursuant to section 295-390 of the ITAA 1997). An actuary’s certificate was required to determine that proportion, which represented the part of the assets that were used to enable the fund to meet its pension liabilities, and which applied for the whole year.

For financial years 2017/18 and beyond, the fund’s trustee(s) must use the segregated method* for ECPI purposes at any time when the fund has segregated current pension assets. This means that if a fund is entirely in pension phase for a certain part(s) of the year but has a combination of retirement phase and accumulation accounts for the rest of the year, the ATO expects the fund to calculate the ECPI using the segregated method where there were segregated assets, and the unsegregated method (i.e. actuarial certificate) where there were pooled assets. There may be several periods where the assets were unsegregated, and an ECPI proportion is calculated for each of them, and then used to produce a single tax-exempt proportion which is to be applied to all income generated in the part(s) of the income year where the assets were unsegregated.

The actuary’s certificate will verify that the assets are sufficient to pay, in part or in full, the benefit liabilities as they fall due (pursuant to section 295-385 of the ITAA 1997).

This position did not significantly alter the amount of ECPI that funds enjoyed, but was a fundamental change from the previous industry practice where trustees have used the unsegregated method to calculate the ECPI for the whole year even though the fund may have been a segregated fund for part of the year.

The position had changed again, and for financial years 2021/22 and beyond, the trustees have the choice of using:

a) the calculation method that applied up until then, i.e. the segregated method for periods when the fund was entirely in pension phase, and the unsegregated method for periods where there were non-pension assets (with or without some pension assets), and

b) the calculation method that produces a single ECPI for the whole year, i.e. the method that applied up until 1 July 2017.

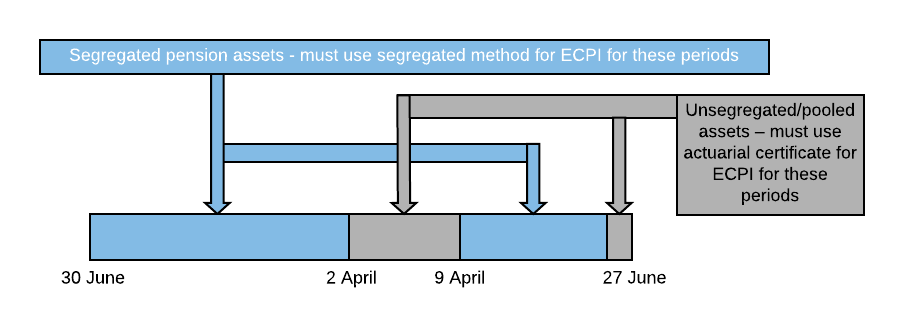

A fund may switch from segregated to unsegregated several times during a year (for example, as a result of new contributions / rollovers followed later by the commencement of additional retirement phase pensions). In such cases, if the trustees have chosen method (a) above, the fund may have to switch numerous times during the year between tax exemption methods. The diagram below illustrates this.

Here the fund was fully in retirement pension phase from 1 July until 2 April when a contribution was made. On 9 April the contribution was used to start an additional pension. On 27 June a further contribution was made, and the fund then remained unsegregated until 30 June. The unsegregated method is used to calculate the ECPI proportion for each of the periods 2 April – 8 April and 27 June – 30 June, and from those two ECPI proportions a single tax-exempt proportion is derived which can be applied to all of the income generated in both unsegregated periods combined.

If however the trustees have chosen method (b) above, a single ECPI for the whole year will be calculated and shown on the certificate.

Transition to Retirement Income Streams (TRIS)

Another change that took place with effect from 1 July 2017 is the treatment of Transition to Retirement Income Streams – a TRIS is no longer an “eligible” pension balance for ECPI purposes until the recipient (a) reaches age 65, or (b) advises the trustee that he/she has met one of these conditions of release:-

(i) retirement, or

(ii) permanent incapacity, or

(iii) has a terminal medical condition.

The result of this change is that only investment income generated from assets that support other retirement phase pensions is exempt from tax.

It should be noted also that when the TRIS recipient reached age 65, the ongoing pension is not simply called an account based pension – instead it changes from being called a pre-retirement TRIS to a post-retirement TRIS.

Actuarial Requirements

If method (a) above is selected, actuaries will require a considerable amount of data, such as:-

(i) the date when assets switched from being segregated assets to being pooled and vice versa (e.g. 2 April and 27 June in the above example);

(ii) the market value of each account balance at these “switching” dates; and

(iii) details of transactions that occurred during each period, such as date, amount, type of transaction (e.g. concessional contributions, non-concessional contributions, rollovers in / out, pension payments, lump sum payments).

Providing this information is a considerable administrative burden on the fund’s trustees, which can be removed by keeping a small accumulation balance throughout the year when there is a potential to receive contributions, or by choosing to use method (b) above.

Certificate Request Form

To obtain a certificate manually, download the request form Account based data, complete it, and email it back to us – the certificate will then be emailed to you within a few hours. The size of the request form is automatically adjusted according to the number of members and the number of unsegregated periods. It is therefore not possible to have a pdf version of the form.

When completing the form, it should be noted that the values of the assets must be market values.